# The Importance of Financial Education and Top-Rated Tools to Help You

In today’s fast-paced financial world, understanding how to manage your finances effectively is more crucial than ever. With an array of investment options, types of saving accounts, and planning strategies for retirement, navigating through these can be complex. Fortunately, financial education tools have evolved to help individuals grasp the basics of finance, budgeting, saving, and investing. This article delves into the importance of financial education and highlights some top-rated tools to aid in your financial literacy journey.

Understanding Financial Education

Financial education equips individuals with the knowledge required to make informed and effective decisions through their understanding of finances. Topics usually cover budgeting, investing, saving, debt management, and planning for retirement. With a solid foundation in these areas, individuals can improve their financial health, reduce stress related to money, and achieve their financial goals.

Benefits of Financial Education

Enhanced Financial Management Skills

Proper financial education allows individuals to create budgets, manage debt, and save efficiently, leading to better financial decisions.

Increased Savings and Investment Opportunities

With the right knowledge, individuals can identify and leverage suitable saving accounts and investment opportunities for their future.

Reduced Financial Stress

Understanding personal finances and having control over them significantly reduces stress, providing peace of mind regarding financial security.

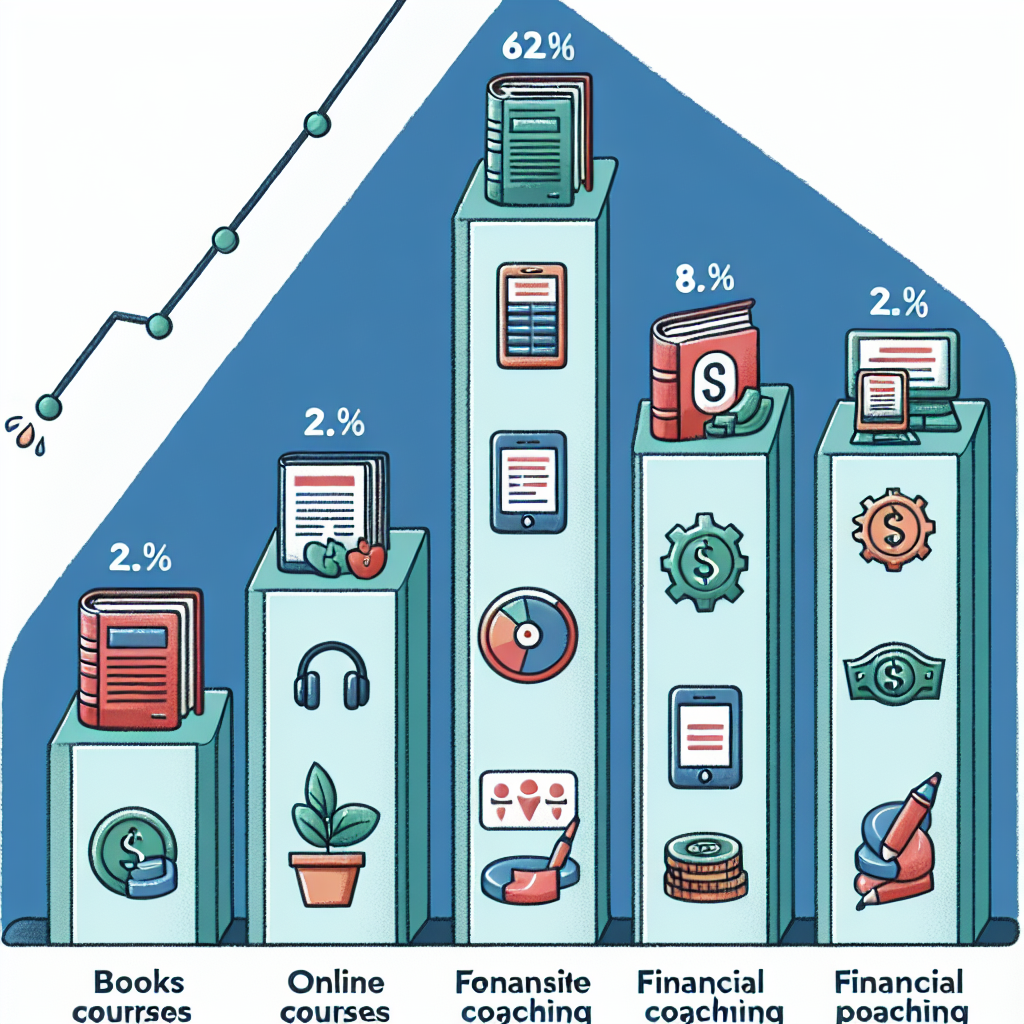

Top-Rated Financial Education Tools

Several online tools and resources have gained recognition for providing valuable financial education. These tools offer various ways to learn, including interactive courses, articles, videos, and financial planning tools. Below are some of the highest-rated options available.

Mint

Mint is a widely acclaimed personal finance app that helps users create budgets, track spending, and provides financial tips. It’s particularly beneficial for beginners looking to get a grasp on their finances.

Khan Academy

Khan Academy offers comprehensive, easy-to-understand courses on a wide array of topics, including personal finance. It’s a great resource for individuals who prefer a structured approach to learning.

NerdWallet

NerdWallet provides a wealth of information on banking, investing, and insurance. It also offers tools like budget calculators and advice on credit score improvement, making it a valuable resource for financial planning and education.

Investopedia

Investopedia features in-depth articles, tutorials, and simulators on investment and financial strategies. It is perfect for those looking to delve deeper into the world of finance.

Personal Capital

Personal Capital is a tool for those who want a comprehensive view of their finances, including investments. It offers financial planning and wealth management services, making it suited for more advanced financial education and tracking.

Conclusion

Financial education is a critical step toward achieving financial freedom and security. With the right tools and resources, anyone can enhance their understanding of finance and learn to manage their money more effectively. Whether you’re a beginner or looking to expand your knowledge, the tools highlighted above provide a great starting point on your journey to financial literacy.