# Introduction to Elliott Wave Forecasting Models

Elliott Wave Theory is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Developed by Ralph Nelson Elliott in the 1930s, this theory asserts that stock market prices unfold in specific patterns, which practitioners today refer to as “waves.”

##

Understanding the Basics of Elliott Wave Theory

At the heart of Elliott Wave Theory is the idea that market movements are driven by collective human psychology or crowd behavior, which moves between optimism and pessimism in natural sequences. These mood swings create patterns evidence in the price movements of markets. According to Elliott, these movements can be predictable and are divided into impulse waves, that move with the overall trend, and corrective waves, that move against it.

###

Impulse Waves

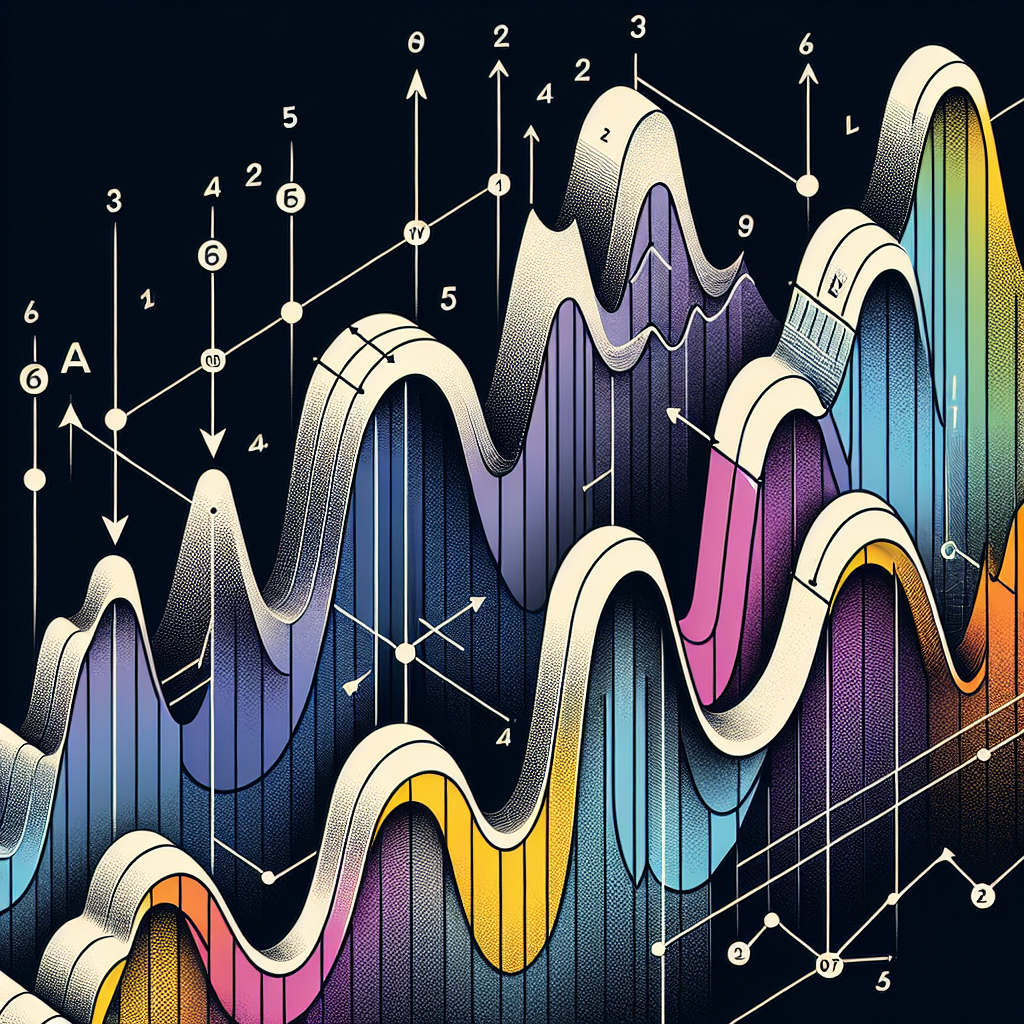

Impulse waves consist of five lower degree waves: three of them follow the trend (waves 1, 3, and 5) and two correct it (waves 2 and 4). This structure is labeled as a 5-wave move in the direction of the trend.

###

Corrective Waves

Corrective waves, on the other hand, typically consist of three waves: two in the direction of the correction (waves A and C) and one against it (wave B). This structure is labeled as a 3-wave move against the trend.

##

Applying Elliott Wave Theory in Trading

Elliott Wave enthusiasts argue that the theory provides them with high probabilities of anticipated market moves. This estimation is based on which waves the market is currently producing, allowing traders to make predictions on the future direction of the market movement.

###

Identifying the Wave Count

The first step in applying the Elliott Wave Theory is correctly identifying the wave count. This involves determining whether the market is currently in an impulse or corrective wave, and which wave within that sequence it is presently forming.

###

Planning Your Trade

Once the wave count has been established, traders often plan their trades around the conclusion of correction waves, entering at the start of an impulse wave in the direction of the trend for higher probability setups.

###

Risk Management

Like with all trading strategies, effective risk management rules are critical when using the Elliott Wave Theory. This often involves setting stop-loss orders just beyond the point where the wave count would be invalidated.

##

Limitations of Elliott Wave Forecasting Models

While Elliott Wave Theory can be a powerful tool in forecasting market movements, it comes with its limitations. The theory is highly subjective, and identifying wave counts is not always straightforward. Furthermore, because financial markets are influenced by countless factors, no single forecasting method can predict market movements with 100% accuracy.

##

Conclusion

Elliott Wave Theory offers a framework for analyzing financial markets through the lens of crowd psychology and pattern recognition. While it requires considerable practice to apply effectively, and comes with its share of limitations, it remains a popular tool among many technical analysts and traders. As with any trading strategy, success with Elliott Wave forecasting models depends not only on the accurate analysis but also on sound money management and emotional discipline.