# Dow Theory in Market Forecasting

## Introduction

The stock market is a complex system that economists, traders, and analysts try to decode daily, employing various strategies and theories to predict future movements. One of the earliest and most enduring frameworks used for this purpose is the Dow Theory, a set of principles for analyzing market trends that were formulated over a century ago. Despite its age, the Dow Theory remains a foundational element of technical analysis and market forecasting.

##

What is Dow Theory?

The Dow Theory was developed by Charles H. Dow, a journalist and the co-founder of the Dow Jones Company. It is often considered the genesis of modern technical market analysis. Though Dow never formalized his ideas into a theory, subsequent editors and thinkers, notably S.A. Nelson, William Peter Hamilton, and Robert Rhea, distilled and expanded upon his work. The Dow Theory addresses not only stock market analysis but also the principles of how markets behave.

##

Primary Tenets of Dow Theory

Dow Theory is underpinned by six major tenets that outline the core of its predictive apparatus:

###

1. The Market Discounts Everything

This principle posits that all publicly available information is already reflected in stock prices, including past, present, and even future details insofar as they are known or anticipated by the market overall.

###

2. The Market Has Three Movements

According to Dow, the market moves in three ways: the “Primary Trend” (the major movement, upward or downward, that may last from a year to several years), the “Secondary Trend” (a corrective movement within the primary trend, lasting from a few weeks to a few months), and the “Minor Movements” (short-term fluctuations that are largely unpredictable and considered noise).

###

3. Major Trends Have Three Phases

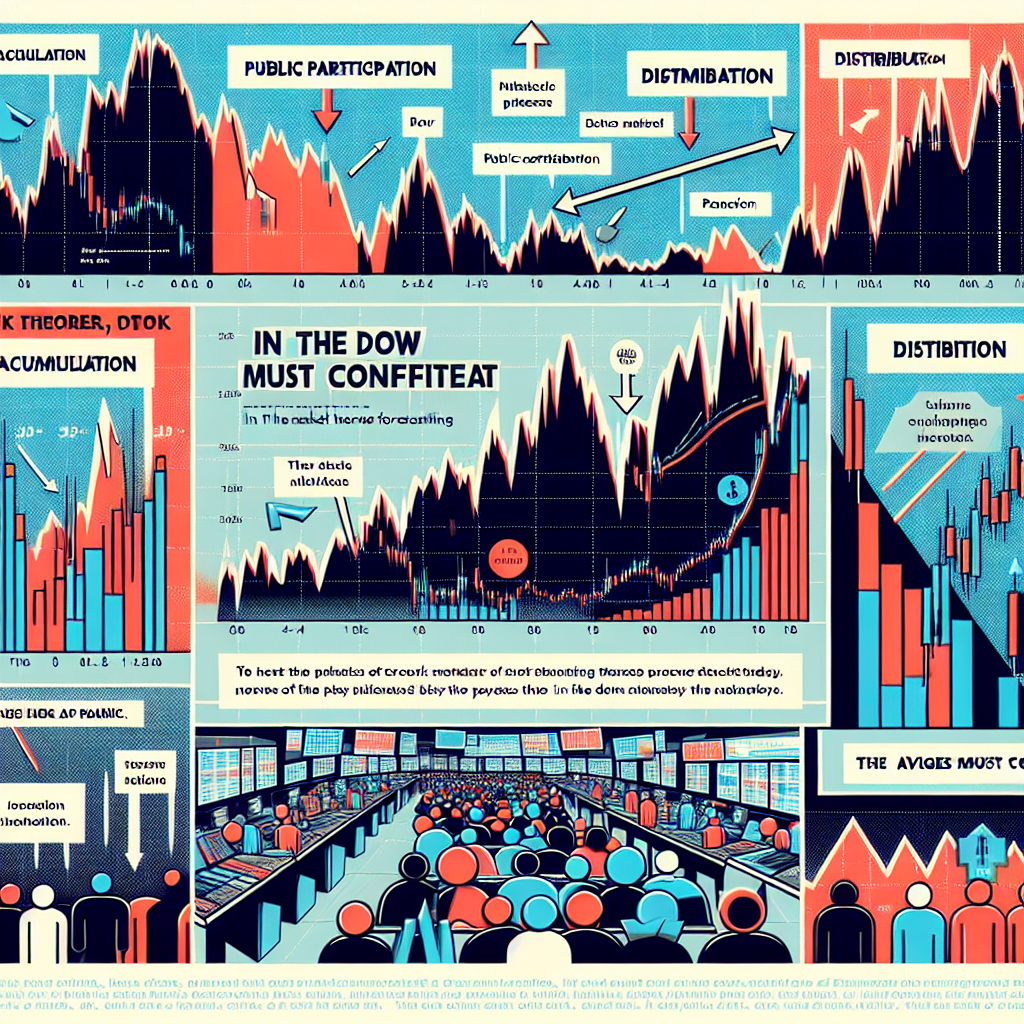

The major trends in the market unfold in three key phases: the accumulation phase, where insightful investors begin to buy or sell against the general market sentiment; the public participation phase, where the majority catch on and market volume increases; and the distribution phase, where savvy investors start to exit their positions.

###

4. Indices Must Confirm Each Other

For a market trend to be confirmed, the industrial and transportation indices should corroborate each other. If one index is achieving new highs or lows, the other should ideally mirror these movements, confirming the overall market direction.

###

5. Volume Must Confirm the Trend

Volume plays a crucial role in validating market trends. For a trend to be considered robust, volume should increase with the direction of the trend. For example, in a bull market, volume should increase when prices are moving up and decrease during corrections.

###

6. Trends Continue Until Definitive Signals Prove Otherwise

The final tenet is that a prevailing trend is expected to continue until clear signals dispute its direction. This principle underscores the theory’s reliance on trend analysis and its conservative stance toward predicting trend reversals.

##

Applying Dow Theory in Modern Market Forecasting

Despite its age, the principles of Dow Theory still form the basis of much of modern technical analysis. Traders and analysts use its tenets to analyze price movements and volumes in an attempt to predict future trends. Key to its application is the focus on long-term observations, ignoring minor fluctuations that can lead to impulsive decisions.

##

Challenges and Criticisms

While Dow Theory has contributed significantly to the fields of technical analysis and market forecasting, it is not without its critics. Some argue that the increasing complexity of global markets and the advent of algorithmic trading have diminished the applicability of some of its tenets. Nonetheless, the principles of trend analysis, market phases, and volume confirmation remain relevant for many market analysts.

## Conclusion

The Dow Theory offers a foundational approach to understanding and forecasting market trends. Its principles have endured because they speak to the underlying behaviors of markets and their participants. While not without limitations, incorporating Dow Theory into broader market analysis can provide valuable insights into market directions and investor sentiment, proving that Charles H. Dow’s legacy continues to influence how we understand and predict market movements.